Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be held on May 8, 2024 Important Notice Regarding the Availability of Proxy Materials

for the Shareholder Meeting to be held on May 10, 2016

| | | | | | |  | | | | | | To Our

Shareholders

|

Dear Fellow Shareholders:

I am pleased to invite you to our Annual Meeting of Shareholders to be held on May 10, 2016 at our corporate offices in Beachwood, Ohio. As we have done in the past, in addition to considering the matters described in our 2016 Proxy Statement, we will present an update regarding the Company’s performance this past year as well as our outlook for the business in 2016 and beyond.

After my first year leading the organization, we are a much stronger company that has successfully navigated a portfolio evolution, effectuated a dramatic shift in our capital allocation strategy and embraced change in our management team and corporate culture. Our operating platform and the efforts of our entire DDR team to foster a culture of excellence continue to produce impressive results, and the many accomplishments we achieved in 2015 were representative of our desire to deliver shareholder value over both the short and long term.

Our high-quality portfolio enabled us to generate strong EBITDA and net asset value growth, and increase our dividend by over 11% compared to 2014. This increase represents the fifth consecutive year of annual dividend growth in excess of 10% while still maintaining a low payout ratio. Our operating platform and portfolio performed exceptionally well, highlighted by our portfolio leased rate of 96.0% at year-end and leasing volume of over 10 million square feet for the sixth consecutive year. We completed over $1.6 billion of acquisitions and dispositions, and focused on owning only the highest quality “dirt” that will continue to appreciate and attract best-in-class retailers. Additionally, we placed $158 million of redevelopments into service at a yield of approximately 10%, materially increasing asset quality and long-term growth expectations. Organic and external growth translated into a blended 4.1% increase in rent per square foot for the portfolio relative to 2014.

We are laser-focused on enhancing shareholder value and maintaining a strong portfolio performance that is sustainable in all economic cycles. I am proud of the successful execution of our strategic plan and I am confident that our continued focus on quality and performance will translate into superior net asset value creation over the long term. We appreciate your support and take very seriously our role as stewards of your capital.

I look forward to seeing you at the Annual Meeting.

Respectfully yours,

DAVID J. OAKES

President and Chief Executive Officer

20162024 Proxy Statement Table of Contents

DDR Corp.ï 2016 Proxy Statement i

PROXY STATEMENT SUMMARY ii DDR Corp.ï 20161. Proxy Statement Summary

1. Proxy Summary

This Proxy Statement Summary contains highlights and information that can be found elsewhere in this Proxy Statement as indicated by the applicable page references. This summary does not contain all of the information that you should consider, and therefore you should read the entire Proxy Statement. 2024 Annual Meeting of Shareholders MEETING DATE, TIME AND LOCATION

| | | | | | Date and Time: | | Wednesday, May 8, 2024 at 9:00 a.m. Eastern Time | | | | Location: | | SITE Centers Corp. (“we,” “our,” “us,” the “Company” or “SITE Centers”) will hold its 2024 Annual Meeting of Shareholders (the “2024 Annual Meeting” or the “Annual Meeting”) in a virtual meeting format via the Internet at www.meetnow.global/MF72XG4. You will not be able to physically attend the Annual Meeting in person. For more information on how to attend and vote at the Annual Meeting, see “Frequently Asked Questions—How do I attend and vote at the virtual Annual Meeting?” on page 60 of this Proxy Statement. | | | | Record Date: | | March 15, 2024 | | | | Mail Date: | | We will begin mailing this Proxy Statement and the accompanying Notice of Annual Meeting of Shareholders, 2023 Annual Report and Proxy Card on or about April 2, 2024 to all shareholders of record entitled to vote. |

TUESDAY, MAY 10, 2016 AT 9:00 A.M. LOCAL TIME

DDR Corp. Offices

3333 Richmond Road

Beachwood, Ohio 44122Voting Matters and Board Recommendations

PROPOSALS

| | | | | | | | MATTER | | | | PAGE | | BOARD RECOMMENDATION | | Proposal 1: | | Election of eight Directors | | 7 | | For each Director nominee | | Proposal 2: | | Authorization of the Company’s Board of Directors (the “Board”) to effect, in its discretion, a reverse stock split of the Company’s common shares and adoption of a corresponding amendment to the Company’s Fourth Amended and Restated Articles of Incorporation (the “Articles of Incorporation”) | | 22 | | For | | Proposal 3: | | Approval, on an advisory basis, of the compensation of the Company’s named executive officers | | 26 | | For | | Proposal 4 | | Ratification of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm | | 54 | | For |

How to Vote Shareholders of record (i.e., shareholders who own shares in their own name as reflected in the records of our transfer agent, Computershare Trust Company, N.A. (“Computershare”)) may vote their shares in any of the following ways: | | | | | By Internet: To submit a proxy over the Internet, go to www.investorvote.com/sitc. You will need the control number that appears on your Notice of Annual Meeting of Shareholders and Proxy Card. | |

| |  | | | | | | By Telephone: To submit a proxy by telephone, call toll free 1-800-652-8683. You will need the control number that appears on your Notice of Annual Meeting of Shareholders and Proxy Card. | | | |  | | | | | | By Mail: If you received a full paper set of proxy materials, date and sign your Proxy Card and mail it in the enclosed, postage-paid envelope. You do not need to mail the Proxy Card if you are submitting your proxy by Internet or telephone. | | | |  | | | | | | At the Meeting: To vote at the Annual Meeting, visit www.meetnow.global/MF72XG4. You will need the control number that appears on your Notice of Annual Meeting of Shareholders and Proxy Card. | | | |  |

| | | | SITE Centers Corp.ï 2024 Proxy Statement | | 1 |

PROXY STATEMENT SUMMARY Shareholders whose shares are held of record by a broker, bank, trust or other nominee may vote their shares by following the instructions provided by such broker, bank, trust or other nominee or at the Annual Meeting. Please note that if your shares are held of record by a broker, bank, trust or other nominee, you must register in advance in order to vote electronically at the Annual Meeting. To register in advance, you must forward a legal proxy from your broker, bank, trust or other nominee holding your shares to Computershare at legalproxy@computershare.com no later than 5:00 p.m. Eastern Time on Friday, May 3, 2024. You will receive a confirmation of your registration, with a control number, by email from Computershare. At the time of the meeting, go to www.meetnow.global/MF72XG4 and enter your control number. Even if you intend to attend the Annual Meeting, we encourage you to submit your proxy in advance of the Annual Meeting. 2024 Director Nominees | | | | | | | | Proposal | | Board Recommendation | | Page Reference for More Information | 1. | | Election of nine Directors. | | ü “For” all nominees | | 2 | 2. | | Approval, on an advisory basis, of the compensation of the Company’s named executive officers. | | ü “For” | | 16 | 3. | | Ratification of PricewaterhouseCoopers LLP as our independent registered public accounting firm. | | ü “For” | | 46 |

| | | | | | | | | | | | | | | | | | | | | | | | CURRENT COMMITTEE MEMBERSHIPS | DIRECTOR NAME | | AGE | | SINCE | | INDEPENDENT | | AUDIT | | COMPENSATION | | NOMINATING

AND ESG | | DIVIDEND

DECLARATION | | PRICING | Linda B. Abraham | | 61 | | 2018 | | Yes | | ✔ | | | | ✔ | | | | | Terrance R. Ahern* | | 68 | | 2000 | | Yes | | ✔ | | Chair | | | | ✔ | | ✔ | Jane E. DeFlorio | | 53 | | 2017 | | Yes | | Chair | | ✔ | | | | | | ✔ | David R. Lukes | | 54 | | 2017 | | No | | | | | | | | Chair | | Chair | Victor B. MacFarlane | | 72 | | 2002 | | Yes | | | | | | Chair | | | | | Alexander Otto | | 56 | | 2015 | | Yes | | | | | | | | | | | Barry A. Sholem | | 68 | | 2022 | | Yes | | | | | | ✔ | | | | | Dawn M. Sweeney | | 64 | | 2018 | | Yes | | ✔ | | ✔ | | | | | | |

VOTING

You may vote if you were a shareholderIn accordance with Alexander Otto’s 2009 investor rights agreement and the number of record at the closeour common shares owned by Alexander Otto and certain members of business on March 15, 2016,his family (the “Otto Family”) as of the record date for the Annual Meeting, the Otto Family was entitled to propose one Director for nomination at the Annual Meeting. The Otto Family has proposed, and the Board has nominated, Mr. Otto for election at the Annual Meeting.

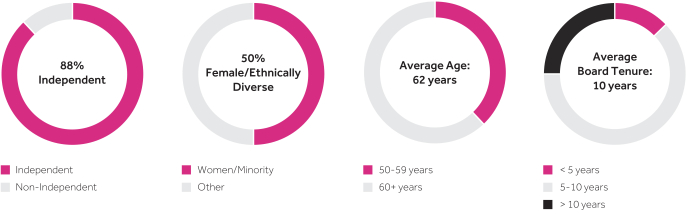

Our Board strives to maintain an independent, balanced and diverse set of Directors that collectively possess the expertise to ensure effective oversight of management. Three of our Director nominees are women and one of our Director nominees is African American.

| | | | 2 | | SITE Centers Corp.ï 2024 Proxy Statement |

PROXY STATEMENT SUMMARY 2023 Performance Highlights The Company produced strong operating results in 2023 and continued to take advantage of favorable leasing conditions that emerged following the COVID-19 pandemic driven by an increase in demand from retailers for space and limited new supply in the markets where the Company operates. Population movements to affluent suburbs in which many of the Company’s properties are located, hybrid work environments and retailers’ efforts to pursue omnichannel distribution to customers through a combination of in-store shopping, curbside pickup and ship-from-store collectively contributed to elevated leasing activity and rent growth across the Company’s portfolio, including with respect to space vacated by tenant fallout from 2023 bankruptcies. As a result of this leasing activity, the Company had executed leases at December 31, 2023 representing approximately $14.2 million of annual base rent on a pro rata basis for which tenants’ obligations to pay rent had not yet commenced, which future rent commencements are expected to contribute to operating results in 2024 and beyond. The Company also took important steps in 2023 in pursuit of its strategy to invest in convenience properties positioned on the curbline of well-trafficked intersections that offer enhanced opportunities for cash flow growth due to reduced operating capital expenditure requirements and their depth and mix of leasing prospects. Following significant disposition activity in the third quarter of 2023 and ongoing efforts to legally separate a number of convenience retail properties from the Company’s existing properties, in October 2023 the Company announced plans to spin off its portfolio of convenience retail properties into a new growth company called Curbline Properties Corp. (“Curbline Properties”) which is expected to occur on or about October 1, 2024. Curbline Properties is expected to be the first publicly-traded REIT exclusively focused on the convenience property sector. As part of the Company’s announcement of its plans to form Curbline Properties, the Company also disclosed that it had obtained a commitment from affiliates of Apollo, including ATLAS SP Partners, to provide a $1.1 billion mortgage facility that is expected to be funded prior to the spin-off of Curbline Properties for the purpose of repaying all of the Company’s unsecured debt, including all outstanding public notes. Additional highlights of the Company’s 2023 accomplishments include: | | | | Operations | | •The Company signed new leases and renewals aggregating approximately 3.3 million square feet of gross leasable area (“GLA”) at the Company’s share. These leases are expected to contribute to growth in property revenues in 2024 and beyond. •For the comparable leases executed in 2023, at the Company’s share, the Company generated positive cash leasing spreads of 29.5% for new leases and 6.5% for renewals. •Reported annualized base rent per occupied square foot of $20.35 at December 31, 2023, as compared to $19.52 at December 31, 2022, both on a pro rata basis. The year-over-year increase was primarily due to the impact of asset sales and was also favorably impacted by property acquisitions and leasing results. •Reported aggregate portfolio occupancy of 92.0% at December 31, 2023 compared to 92.4% at December 31, 2022, both on a pro rata basis. The year-over-year decline was primarily related to 2023 tenant bankruptcy activity and the sale of properties with higher occupancy rates, partially offset by new leasing activity and acquisitions. •Initiated a restructuring plan to align the Company’s cost structure and technology platform with current and future expected operations. The restructuring plan is expected to lead to an annualized reduction in General and administrative and Operating and maintenance expenses and non-real estate depreciation and amortization of approximately $3.7 million. | | Transactions | | •Acquired 12 convenience properties for an aggregate price of approximately $165.1 million. •Sold 22 shopping centers for $966.6 million ($876.9 million at the Company’s share). | | Capital Markets Activity | | •Closed a five-year $380.6 million ($76.1 million at share) mortgage secured by the ten-property Dividend Trust Portfolio (“DTP”) joint venture portfolio. •Closed a five-year $100 million mortgage secured by Nassau Park Pavilion (Princeton, NJ). •In the second quarter of 2023, repurchased 140,633 Operating Partnership (“OP”) units in a privately negotiated transaction at an aggregate cost of $1.7 million or $12.34 per unit. Following the repurchase, the Company had no outstanding OP units. •In the first quarter of 2023, repurchased 1.5 million of the Company’s common shares in open market transactions at an aggregate cost of $20.0 million or $13.43 per common share funded with proceeds from property dispositions. |

| | | | SITE Centers Corp.ï 2024 Proxy Statement | | 3 |

PROXY STATEMENT SUMMARY Corporate Governance Highlights We are committed to the highest standards of corporate governance, which we believe will begin mailingensure that the Company is managed for the long-term benefit of our stakeholders. We monitor developments and best practices in corporate governance and consider feedback from shareholders when evaluating our governance, policies and structure. | | | Director Elections | | • Annual election of all Directors • Majority voting for Directors in uncontested elections | Board Practices | | • Separate independent Chairman of the Board and Chief Executive Officer (“CEO”) • Significant Board oversight of business strategy • Regular executive sessions of independent Directors • Annual executive officer succession planning discussions • Anti-overboarding policy limiting service on other public company boards • Mandatory Director retirement age (76 years) • Annual Director review of enterprise risk assessment • No ability to classify the Board without shareholder consent | Shareholder Rights | | • Proxy access (3% ownership, 3 years, greater of 2 nominees or 20% of Board) • Ability to amend Articles of Incorporation and Code of Regulations by majority vote • Ability to call special meetings (25% of voting power) • Ability to act by unanimous written consent | Other Policies | | • Prohibition on pledging, hedging and other derivative transactions in Company securities by Directors and officers • Share ownership requirements for Directors and executive officers |

Corporate Values, Human Capital and Sustainability Our Company and its 225 employees (as of year-end 2023) are committed to being Fearless, Authentic, Curious and Thoughtful (our “Matters of FACT”) members of the community. We consider social and environmental issues in all aspects of our business, including the well-being of our employees and our impact on the communities in which our properties are located. Recent recognition includes: Our dedication to our community and the environment is detailed in our ninth annual Corporate Responsibility and Sustainability Report (the “CSR Report”) which was prepared in 2023 in alignment with Global Reporting Initiative (“GRI”) principles and certain Sustainability Accounting Standards Board (“SASB”) and Task Force on Climate-Related Financial Disclosures (“TCFD”) standards. Our CSR Report can be found on our website at www.sitecenters.com/sustainability. The information contained in the CSR Report is not incorporated by reference into this Proxy Statement, the Noticeand you should not consider such information to be part of Annual Meeting of Shareholders and letter from our President and Chief Executive Officer, along with the accompanyingthis Proxy Card on or about March 31, 2016 to all shareholders entitled to vote. You may vote your shares in person at the Annual Meeting or vote by proxy in any of the following ways:Statement.

| | | | | | | | | | | | | | By Internet4 | | SITE Centers Corp.ï 2024 Proxy Statement |

PROXY STATEMENT SUMMARY Compensation Practices The Compensation Committee oversees the design and administration of the Company’s executive compensation programs. Our compensation programs reward executives not only for delivering superior returns but also for reducing the risk profile of the Company and achieving financial and non-financial measures of performance that enhance long-term shareholder and stakeholder value. The following are key features of our executive compensation programs. What We Do | | |  | | By TelephoneWe tie pay to performance by making a

significant portion of compensation “at risk”. | | |  | | Annual incentive pay is typically based on one or more performance metrics, which are established at the beginning of each year, and individual performance. | | |  | | By MailA significant portion of the value of long-term performance incentives depends on relative shareholder return. | | | | | |

Go to:

www.investorvote.com/ddr

or the web address on

your Proxy Card

| | | |

Dial toll free:

1-800-652-8683

| | | |

Sign the enclosed Proxy Card

and return by

pre-paid postage envelope

|

What We Don’t Do | | |  | | We do not guarantee minimum incentive bonus awards. | | |  | | We do not encourage excessive risk taking as we use different performance metrics for our annual and long-term incentive compensation programs. | | |  | | We do not pay dividend equivalents on unearned equity awards subject to performance-based vesting. | | |  | | We do not allow for repricing of stock options without shareholder approval. | | |  | | We do not include excise tax gross-up provisions in our executive compensation arrangements. | | |  | | We do not offer excessive perquisites or special health and welfare plans to executives. |

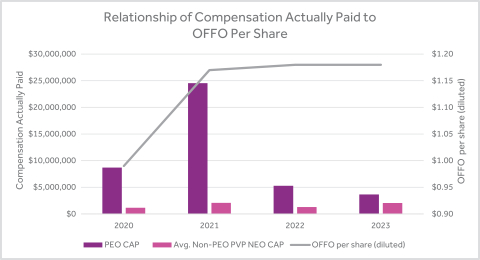

Pay Aligned With Performance DDR Corp.ï 2016

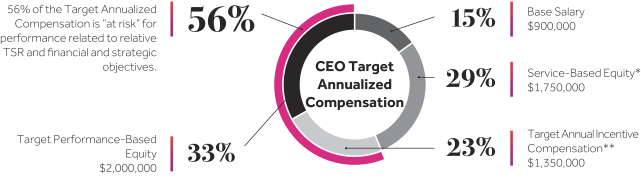

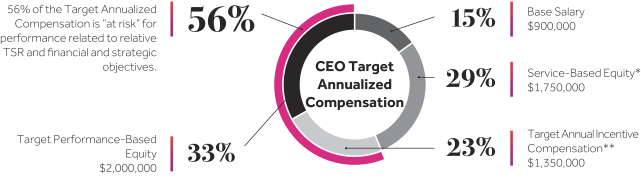

Our executive compensation is aligned with Company performance. The majority of the targeted level of annualized compensation for our CEO under the September 2020 employment agreement that governed his 2023 compensation was variable and “at risk” based on performance.

| * | Includes the annualized grant date fair value of the service-based restricted share units (“RSUs”) awarded in connection with the execution of Mr. Lukes’ September 2020 employment agreement and the value of service-based RSUs to be granted to Mr. Lukes annually during the term of his employment agreement. |

| ** | Annual incentive is shown at the target level. The annual incentive payout ranges from $0 (below threshold) to $2,250,000 (maximum). Mr. Lukes can elect by October 31 of each year to receive the value of his annual incentive award for such year (payable by March 15 of the following year) in RSUs at a 20% increase. |

| | | | SITE Centers Corp.ï 2024 Proxy Statement | | 5 |

PROXY STATEMENT SUMMARY 2023 Executive Compensation The table below summarizes 2023 compensation awarded or paid to our named executive officers as reported in the 2023 Summary Compensation Table included in this Proxy Statement 1Statement. Our Compensation Committee typically establishes both quantitative and qualitative performance metrics governing our annual incentive compensation program in the first quarter of each year. In March 2023, the Compensation Committee established our 2023 annual incentive compensation program. The 2023 annual compensation program included both a quantitative performance metric, namely Operating FFO, and subjectively-evaluated qualitative performance metrics. The quantitative metric comprised 50% of the program’s overall assessment of executive performance. The remaining 50% of the annual incentive award program involved a qualitative assessment of each named executive officer’s individual performance. Based on the Compensation Committee’s evaluation in early 2024 of executive performance during 2023, including the Company’s achievements outlined in “2023 Performance Highlights” above, Messrs. Lukes (President and CEO), Conor M. Fennerty (Executive Vice President (“EVP”) and Chief Financial Officer (“CFO”)) and John M. Cattonar (EVP and Chief Investment Officer (“CIO”)) and Ms. Christa A. Vesy (former EVP and Chief Accounting Officer (“CAO”)) were awarded 2023 incentive compensation payouts of $2,250,000, $900,000, $750,000 and $510,000, respectively, which represented the maximum amount of the annual incentive award opportunities provided for under their employment agreements in effect at the end of 2023. All executives received their 2023 incentive compensation payments in cash. Of the approximately $6.7 million total compensation reported for Mr. Lukes in the 2023 Summary Compensation Table, approximately $2.6 million consisted of the grant date fair value of an annual award of performance-based RSUs, which become payable, if at all, based on the percentile rank of the Company’s total shareholder return (“TSR”) measured over a three-year period relative to an identified group of peer companies. For more details on 2023 executive compensation, including factors considered by our Compensation Committee in evaluating the qualitative elements of the 2023 annual incentive compensation program, see the “Compensation Discussion and Analysis” section beginning on page 28 of this Proxy Statement and the 2023 Summary Compensation Table on page 41 of this Proxy Statement. | | | | | | | | | | | | | | | | | | | | | | | NAMED

EXECUTIVE

OFFICER | | POSITION | | SALARY | | | BONUS | | STOCK

AWARDS | | | NON-EQUITY

INCENTIVE PLAN

COMPENSATION | | | ALL OTHER

COMPENSATION | | TOTAL | | David R. Lukes | | President and CEO | | $ | 900,000 | | | $0 | | | $3,550,043 | | | $ | 2,250,000 | | | $40,607 | | $ | 6,740,650 | | Conor M. Fennerty | | EVP and CFO | | $ | 575,000 | | | $0 | | | $1,902,419 | | | $ | 900,000 | | | $18,930 | | $ | 3,396,349 | | John M. Cattonar | | EVP and CIO | | $ | 475,000 | | | $0 | | | $1,458,668 | | | $ | 750,000 | | | $12,399 | | $ | 2,696,067 | | Christa A. Vesy | | Former EVP and

CAO | | $ | 425,000 | | | $0 | | | $ 177,532 | | | $ | 510,000 | | | $12,744 | | $ | 1,125,276 | |

Historical Say-on-Pay Voting Results | | | | |  | | Shareholders have continued to show strong support for our executive compensation programs with approximately 95%, 97% and 94% of votes cast for the approval of the “say-on-pay” proposals at our 2021, 2022 and 2023 Annual Meetings of Shareholders, respectively. |

| | | | 6 | | SITE Centers Corp.ï 2024 Proxy Statement |

2. Proposal One: Election of Eight Directors Proposal Summary and Board Recommendation At the Annual Meeting, unless you specify otherwise, the common shares represented by your proxy will be voted to elect the nineeight Director nominees of DDR Corp. (DDR or Company).identified below. If any of the Director nominees is not a candidate when the election occurs for any reason (which is not expected) and the size of theour Board remains unchanged, then our Board of Directors (Board) intends that proxies will be voted for the election of a substitute Director nominee designated by our Board as recommended by the Nominating and Corporate GovernanceESG Committee. BOARD RECOMMENDATION: “For” All Nine Director NomineesFOR” ALL EIGHT DIRECTOR NOMINEES Director Nominees for Election at the Annual Meeting Our Board has nominated and recommends that shareholders vote FOR“FOR” the election of each of the following Director nominees, each to serve a one-year term until the next annual meeting of shareholders and until a successor has been duly elected and qualified. All nominees are currently serving as Directors and were elected by the shareholders at the 2023 Annual Meeting. | | | LINDA B. ABRAHAM

Background: Since 2014, Ms. Abraham has served as Managing Director Since: 2000of Crimson Capital, which invests in and advises a broad range of early stage technology companies spanning data/analytics, cybersecurity, machine learning, e-commerce, educational technology, clean energy and healthcare. From 1999 to 2013, Ms. Abraham co-founded and served as Executive Vice President of comScore, a leader in digital measurement and analytics which went public in 2007. Ms. Abraham also served as an Independent Director and chair of the compensation committee of Carlotz, Inc., an online consignment company for used vehicles, from 2021 until 2022. Additionally, she serves on the boards of the School of Data Science at the University of Virginia and Tiger 21, a member-based organization focused on investment management and education. Ms. Abraham has been named a Fellow in the Stanford University Distinguished Careers Institute. Ms. Abraham holds a degree in Quantitative Business Analysis from Penn State University. Age: 60

Independent: Yes

Committees:

• NominatingQualifications:Ms. Abraham’s qualifications to serve on the Board include extensive experience as a technology entrepreneur and Corporate Governance Committee (Chair)

• Dividend Declaration Committee

• Pricing Committee

as an expert in consumer analytics, a field that is critical to the Company’s efforts to understand shopping patterns and merchandise mix. | |

DIRECTOR SINCE: 2018 AGE: 61 INDEPENDENT: YES COMMITTEES: •Audit •Nominating and ESG |

| | | | SITE Centers Corp.ï 2024 Proxy Statement | | 7 |

| | | TERRANCE R. AHERN — Chairman of the Board, DDR Corp.SITE Centers, and Chief Executive Officer,Chairman Emeritus, The Townsend Group (institutional real estate consulting) Background: Mr. Ahern is served as Co-Founder, Principal and Chief Executive Officer of The Townsend Group, an institutional real estate advisory and investment management firm formed in 1986. Mr. Ahern also is a member of the firm’s Investment Committee.1986, until his retirement in May 2022 and currently serves as Chairman Emeritus. The Townsend Group serves as adviser to, or invests on behalf of, domestic and offshore public and private pension plans, endowments and foundations, and sovereign wealth funds. Mr. Ahern has also served as an Independent Director of KKR Real Estate Finance Trust since 2017. Mr. Ahern is a past member of the Young Presidents Organization, the Pension Real Estate Association (PREA)(“PREA”), the National Association of Real Estate Investment Trusts (NAREIT)(“NAREIT”), and the National Council of Real Estate Investment Fiduciaries. He is a former member of the Board of Directors of PREA and the Board of Editors ofInstitutional Real Estate Securities.Securities. Mr. Ahern has been a frequent speaker at industry conferences, including PREA, NAREIT and the National Association of Real Estate Investment Managers. Qualifications:Mr. Ahern has over 2535 years of real estate industry and institutional real estate consulting experience. This experience includes founding and managing a leading institutional real estate advisory and investment firm whose core skill is analyzing real estate firms and investment opportunities. This role and experience provideshas provided Mr. Ahern with unique insight into the structure and operations of both public and private real estate companies, and into the real estate environment and capital markets in which we operate. Through his experience, Mr. Ahern has gained an understanding and knowledge of the opportunities, challenges and risks that face real estate companies, as well as the functions of a board of directors. | |

DIRECTOR SINCE: 2000 AGE: 68 INDEPENDENT: YES COMMITTEES: •Compensation (Chair) •Audit •Dividend Declaration •Pricing |

2 DDR Corp.ï 2016 Proxy Statement

| | | JANE E. DEFLORIO

Age: 67Background: Ms. DeFlorio was Managing Director, Deutsche Bank AG Retail/Consumer Sector Investment Banking Coverage, a division of a global banking and financial services company, from 2007 to 2013. While at Deutsche Bank, Ms. DeFlorio covered a range of mid- to large-cap retail clients. Ms. DeFlorio has served as an Independent Director and chair of the audit committee of Vivid Seats since 2021 and also served as an Independent Director of Perry Ellis International from 2014 to 2018. Ms. DeFlorio is also a member of the Board of Trustees and Chairman of the Audit and Risk Committee at The New School University in New York City. She serves on the Boards of Directors for The Parsons School of Design and the Museum at Fashion Institute of Technology. She also serves on the Advisory Council for the School of Engineering at the University of Notre Dame. Ms. DeFlorio is a graduate of the University of Notre Dame and Harvard Business School.

Independent: YesQualifications: With over 15 years of experience in investment banking, primarily focusing on the retail sector, as well as her service on other public company boards, Ms. DeFlorio is uniquely qualified to advise our Board in connection with capital structure, capital allocation, strategic direction, risk management, financial matters, shareholder value creation and strategic opportunities.

| | THOMAS F. AUGUST — Lead Director, DCT Industrial Trust Inc. (industrial real estate investment trust)

DIRECTOR SINCE: 2017 AGE: 53 INDEPENDENT: YES COMMITTEES: •Audit (Chair) •Compensation •Pricing |

| | | | 8 | | SITE Centers Corp.ï 2024 Proxy Statement |

| | | DAVID R. LUKES President and Chief Executive Officer, SITE Centers Background: Mr. August is Lead DirectorLukes was named President and Chief Executive Officer of DCT Industrial TrustSITE Centers in March 2017. Mr. Lukes previously served as Chief Executive Officer of Equity One, Inc. (DCT)(“Equity One”), an industrial real estate investment trust (REIT). DCT has announced thatowner, developer, and operator of shopping centers, as well as a member of Equity One’s Board of Directors, from 2014 until 2017. Prior to joining Equity One, Mr. August has been designated to serve as Chairman of the Board following the DCT annual meeting of shareholders in May 2016. Mr. August retired from Equity Office Property Trust (EOP) as of December 31, 2015. HeLukes served as President and Chief Executive Officer of EOP from July 2010 and served from October 2009 to July 2010 as its Chairman. EOP is a REIT controlled by The Blackstone Group and is one of the largest owners and managers of office properties in the United States. He remains on the board of directors of EOP. Mr. August previously served as president, chief executive officer, and a trustee of Prentiss PropertiesSears Holding Corporation affiliate Seritage Realty Trust, an office REIT, from 1996 until its acquisition in 2006. Mr. August held other executive roles, including chief financial officer, at Prentiss since 1987. Mr. August also has served in various executive roles with Cadillac Fairview Urban Development, Inc., Oxford Properties, Inc., Behringer Harvard REIT I, Inc. and Citibank. Mr. August holds a bachelor’s degree from Brandeis University and an M.B.A. degree from Boston University. Qualifications: Mr. August has more than 40 years of experience in the real estate industry, including prior experience as the chief executive officer of a publicly-traded REIT. We believe his industry experience provides him with valuable insight into key concerns of our board of directors and the issues and opportunities most relevant to public real estate companies.

|

| | |

Director Since: 2009

Age: 57

Independent: No

(see page 7)

Committee:

• Dividend Declaration Committee

| | DR. THOMAS FINNE — Managing Director, KG CURA Vermögensverwaltung G.m.b.H. & Co. (commercial real estate company, Hamburg, Germany)

Background: Dr. Finne is the Managing Director of KG CURA Vermögensverwaltung G.m.b.H. & Co., a commercial real estate company located in Hamburg, Germany, that manages assets in North America and Europe. Prior to joining KG CURA Vermögensverwaltung G.m.b.H. & Co. in 1992, Dr. Finne was responsible for controlling, budgeting, accounting and finance for Bernhard Schulte KG, a ship owner and ship manager located in Hamburg, Germany. He is currently serving as a director of Sonae Sierra Brasil S.A., which owns and operates retail real estate assets in Brazil. Dr. Finne graduated with an undergraduate degree in business administration and received his doctorate from the International Tax Institute at the University of Hamburg.

Qualifications: Dr. Finne’s experience in international commercial real estate enables him to contribute an international perspective on the issues impacting a real estate company, facing today’s challengesfrom 2012 through 2014. In addition, Mr. Lukes served as the President and opportunities. His currentChief Executive Officer of Olshan Properties (formerly Mall Properties, Inc.), a privately owned real estate firm that specializes in the development, acquisition and past servicemanagement of commercial real estate, from 2010 to 2012. From 2002 to 2010, Mr. Lukes served in various senior management positions at Kimco Realty Corporation, including serving as its Chief Operating Officer from 2008 to 2010. Mr. Lukes also serves as President, Chief Executive Officer and Director of Retail Value Inc. (“RVI”), which previously owned and operated shopping centers located in the continental U.S. and is managed by SITE Centers, and as a Director of Citycon Oyj, an owner and operator of shopping centers located in the Nordic region, the shares of which are traded on the boardNasdaq Helsinki stock exchange. Mr. Lukes holds a Bachelor of directorsEnvironmental Design from Miami University, a Master of international real estate companies further provides him with business modeling experienceArchitecture from the University of Pennsylvania and an appreciable awarenessa Master of the most effective and essential functions of a board of directors.

|

DDR Corp.ï 2016 Proxy Statement 3

| | |

Director Since: 2000

Age: 64

Independent: Yes

Committees:

• Executive Compensation Committee (Chair)

• Audit Committee

| | ROBERT H. GIDEL — Managing Member, Liberty Partners, LLC (real estate investments)

Background:Science in Real Estate Development from Columbia University. Mr. Gidel has been the Managing Member of Liberty Partners, LLC, a company that invests in both private and publicly traded real estate and finance focused operating companies, since 1998. Mr. Gidel has served on the Board of Directors of Nationstar Mortgage Holdings, Inc. since 2012 and was Chairman of Florida Polytechnic University’s Board of Trustees from 2012 to 2014. Mr. Gidel was President of Ginn Development Company, LLC, one of the largest privately-held developers of resort communities and private clubs in the Southeast, from July 2007 until April 2009. Mr. Gidel was Chairman of the Board of Directors of LNR Property Holdings, a private multi-asset real estate company, from 2005 until 2007. Until January 2007, he wasLukes also serves as a member of the Advisory Board of Directors and Lead DirectorGovernors of Global Signal Inc., a real estate investment trust. He was a Trustee of Fortress Registered Investment Trust and a Director of Fortress Investment Fund II, LLC from 1999NAREIT.

Qualifications: Mr. Lukes’ qualifications to 2012, both of which were registered investment companies. From 1998 until 2005, Mr. Gidel wasserve on the independent member of the investment committee of the Lone Star Funds I, II, III, IV and V. Mr. Gidel was alsoBoard include his position as a member of the BoardCompany’s senior management, his prior experiences as chief executive and director of Directors of U.S. Restaurant Properties, Inc. until 2005other shopping center owners and a member ofoperators, his familiarity with the Board of Directors of American Industrial Properties REIT until 2001. Mr. Gidel was elected a NASD Fellowretail real estate investment trust (“REIT”) industry and is on the Board of Directors of University of Florida Investment Corporation.his extensive expertise and experience in retail real estate development and operations. | |

Qualifications: Through his leadership of two public REITs and five private REITs, as well as his service on the board of directors of several public REITs, Mr. Gidel provides our Board with extensive knowledge of the real estate industry, the development and implementation of corporate strategies, risk assessment, corporate finance and governance matters. His experience as a senior manager of several real estate companies enables him to make significant contributions to our Board.DIRECTOR SINCE: 2017

AGE: 54 INDEPENDENT: NO COMMITTEES: •Dividend Declaration (Chair) •Pricing (Chair) |

| | |

Director Since: 2002

Age: 64

Independent: Yes

Committees:

• Executive Compensation Committee

• Nominating and Corporate Governance Committee

| | VICTOR B. MACFARLANE — Managing Principal, Chairman and Chief Executive Officer, MacFarlane Partners (real estate investments) Background: Mr. MacFarlane is Managing Principal, Chairman and Chief Executive Officer of MacFarlane Partners, which he founded in 1987 to provide real estate investment management services to institutional investors. Mr. MacFarlaneinvestors and has more than 3040 years of real estate investment experience. He sitsMr. MacFarlane has served as an Independent Director of Veris Residential, Inc. since 2021 and currently serves on the Boardsits audit committee and compensation committee. Mr. MacFarlane is a co-founder and emeritus board member of Directors of the Robert Toigo Foundation and the Real Estate Executive Council. He also serves on the Board of Advisors for the UCLA School of Law and the board facilities committee of Stanford Hospital & Clinics. He isCouncil, a member and former Trustee of the Urban Land Institute (ULI);and a member and former Director of PREA; and a member of the International Council of Shopping Centers (ICSC), the Chief Executives Organization and the World Presidents’ Organization.PREA. Qualifications: Mr.Mr. MacFarlane brings to our Board nearly three decades of experience as a chief executive officer of a real estate investment and advisory firm and over 3040 years of experience in the areas of real estate investment, corporate finance, portfolio management and risk management. His extensive managerial experience as well as his knowledge of the real estate and private capital industries provide our Board with an expansive view on issues impacting the Company and our corporate strategy. | |

DIRECTOR SINCE: 2002 AGE: 72 INDEPENDENT: YES COMMITTEES: •Nominating and ESG (Chair) |

4 DDR Corp.ï 2016 Proxy Statement

| | |

Director Since: 2015

Age: 38

Independent: No

Committees:

• Dividend Declaration Committee (Chair)

• Pricing Committee (Chair)

SITE Centers Corp.ï 2024 Proxy Statement | | DAVID J. OAKES — President and Chief Executive Officer, DDR Corp.

Background: Mr. Oakes is President and Chief Executive Officer of DDR, a position he assumed on February 10, 2015. He previously served as President and Chief Financial Officer since January 2013, prior to that as Senior Executive Vice President and Chief Financial Officer since February 2010, and prior to that as Chief Investment Officer since April 2007. During his tenure at DDR, Mr. Oakes has overseen the Company’s operations, capital markets, transactions, budgeting, tax, investor relations, funds management, accounting, corporate governance, and compensation and benefits functions. In addition to his other duties and responsibilities, Mr. Oakes chairs the Company’s executive compensation, enterprise risk management, real estate committee, and investment committee.

Prior to joining DDR, Mr. Oakes served as Senior Vice President and Portfolio Manager at Cohen & Steers Capital Management. In his role, he oversaw the firm’s global and international real estate securities portfolios for the oldest and largest dedicated real estate securities fund manager. Previously he worked as a Research Analyst in global investment research at Goldman Sachs, where he covered U.S. REITs.

Mr. Oakes earned his bachelor’s degree at Washington University and is a CFA charterholder. He is a member of NAREIT, ICSC, and the New York Society of Securities Analysts. Mr. Oakes is also a board member of The Gathering Place, a nonprofit dedicated to helping individuals and families affected by cancer.

Qualifications: During his years of service to the Company, Mr. Oakes has gained a comprehensive knowledge of the critical internal and external opportunities and challenges facing the Company and the real estate industry as a whole. His prior experience as a REIT analyst and as a member of the Company’s senior management, including his current role as Chief Executive Officer, make him an invaluable member of the Board of Directors.

9 |

| | |

Director Since: 2015

Age: 48

Independent: No

(see page 7)

| | ALEXANDER OTTO — Chief Executive Officer, ECE Projektmanagement G.m.b.H.Group GmbH & Co. KG (commercial real estate company, Hamburg, Germany) Background: Mr. Otto has served as the Chief Executive Officer of ECE Projektmanagement G.m.b.H.Group GmbH & Co. KG, a commercial real estate company based in Hamburg, Germany that manages assets in Europe, since 2000. Mr. Otto is a graduate of St. Clare’s, Oxford, and studied at Harvard UniversityCollege and Harvard Business School. Mr. Otto is a member of the boards of directors, or equivalent governing bodies, of publicly traded companies Deutsche EuroShop AG and Sonae Sierra Brasil S.A., as well as the privately held companies Otto Group and Peek & Cloppenburg KG. Mr. Otto served as a director of publicly traded company Deutsche EuroShop AG, which owns and operates retail real estate assets in Europe, from 2002 until 2022 and of Sonae Sierra Brasil S.A., which owns and operates retail real estate assets in Brazil, from 2014 until 2019. Additionally, Mr. Otto is the Chairman of Lebendige Stadt (“Vibrant City”)(Vibrant City) Foundation, HSV Campus gemeinnützige GmbH and the Alexander Otto Sportstiftung Foundation, is a member of the board of the Harvard Business School Foundation of GermanyGlobal Advisory Council and, together with his wife, established the Dorit and Alexander Otto Foundation. Qualifications: As chief executive officer of a major international commercial real estate developer and management company, Mr. Otto brings over 20has more than 25 years of experience in the global retailshopping center business. This experience includes serving as a real estate industryanalyst with a focus on financial analysis and appraisals of shopping centers, as well as a development manager and leasing executive for large shopping centers. These qualifications and his experience as the CEO of a leading private European shopping center company enable Mr. Otto to our Board. Mr. Otto’s professional experience, including his leadership positions withinprovide particular insights to the real estate and retail industries, enable him to contribute to our Board’s emphasis onBoard regarding the Company’s corporate strategy, optimizingthe continual optimization of the Company´s operations, enhancing tenant relationshipstransactional activity and focus, and strengtheninggeneral management. | |

DIRECTOR SINCE: 2015 AGE: 56 INDEPENDENT: YES |

DDR Corp.ï 2016 Proxy Statement 5

| | | BARRY A. SHOLEM

Director Since: 2004

Age: 58

Independent: Yes

Committees:

• Audit Committee (Chair)

• Pricing Committee

| | SCOTT D. ROULSTON — Managing Director, MAI Capital Management, LLC (investment advisor)

Background: Mr. Roulston is Managing Director of MAI Capital Management, LLC (MAI), a position which he has held since 2013. MAI is a registered investment advisor. He is a Trustee of the Ohio Police and Fire Pension Fund. He was Managing Director at Burdette Asset Management, a private equity fund manager, from 2011 to January 2013. From 1990 to 2010, he was Chief Executive Officer of Roulston & Company, a firm that provided investment research and management, and its successor firm, Fairport Asset Management. He is Director and Chairman of Bluecoats, Inc. and a Director of University Circle, Inc. He is a former Director of Defiance, Inc., where he served as Chair of the Compensation Committee and member of the Audit Committee. Mr. Roulston is a graduate of Dartmouth College. Qualifications: In addition to his past experience on the board of directors of both public and private companies, including on the audit committee of a public company, Mr. Roulston contributes his insights as a leader of an asset management and private equity company, and a trustee of a major public pension fund. This experience has provided him with extensive knowledge of the issues involved with the review and analysis of financial statements, as well as capital markets and the development and implementation of corporate strategy.

|

| | |

Director Since: 1998

Age: 60

Independent: Yes

Committee:

• Executive Compensation Committee

| | BARRY A. SHOLEM — Partner, MSD Capital, L.P. (family investment office)

Background: Mr. Sholem became a partner ofjoined MSD Capital, L.P., the family office of Michael and Susan Dell, in 2004 and headcurrently serves as Founder and Chairman of its real estate fund in July 2004.MSD Real Estate. From 1995 until 2000, Mr. Sholem was Chairman of DLJ Real Estate Capital Partners, a $2 billion real estate fund that he co-founded and that invested in a broad range of real estate-related assets, and a Managing Director at Credit Suisse First Boston. Prior to forming DLJ Real Estate Capital Partners,Boston, an investment bank. Since 2023, Mr. Sholem spent ten years at Goldman Sachs inhas served as an Independent Director and a member of the nominating and corporate governance committee of Hudson Pacific Properties, Inc. From 2018 until 2022, Mr. Sholem served as a Director of RVI and as a member of its New Yorkaudit, corporate governance and Los Angeles offices.executive committees. From 1998 to 2018, Mr. Sholem served as a Director of the Company, where he served as a member of several board committees. Mr. Sholem is active in ULI (CRC Silver Council)Urban Land Institute (“ULI”), ICSC,the International Council of Shopping Centers (“ICSC”), the University of California, Berkeley Real Estate Advisory Board, Brown University President’s Leadership Council and the Business Roundtable.

Qualifications: Years Mr. Sholem’s qualifications to serve on the Board include years of experience leading the real estate groups of investment firms gives Mr. Sholem a unique perspective on the business and operations of the Company.firms. In addition, he brings a broad understanding of the social and political issues facing the Company through his involvement with ULI and ICSC. | |

DIRECTOR SINCE: 2022 AGE: 68 INDEPENDENT: YES COMMITTEES: •Nominating and ESG |

| | | | 10 | | SITE Centers Corp.ï 2024 Proxy Statement |

| | | DAWN M. SWEENEY Advisor and Principal, New England Consulting Group (marketing management consulting) Background: Ms. Sweeney has served as an advisor and principal of the New England Consulting Group since 2020, focusing on the group’s restaurant and association practices. She has also served as a strategic partner with JLL since 2022 as part of the Non-Profit and Association practice group. Additionally, she serves as an Executive in Residence at The Georgetown University’s McDonough School of Business. Ms. Sweeney served as the President and Chief Executive Officer of the National Restaurant Association, the chief business and national trade association for the restaurant and foodservice industry, from 2007 until her retirement in 2019. Since September 2022, Ms. Sweeney has served as an Independent Director, chair of the compensation, nominating and governance committee and member of the audit committee of Riv Capital, a company listed on the Canadian Securities Exchange. Ms. Sweeney also serves as chair of the board of directors of MedStar’s National Medical Rehabilitation Hospital. Ms. Sweeney earned a Bachelor of Science in Government from Colby College and a Masters of Business Administration in Marketing from The George Washington University. Qualifications: Ms. Sweeney’s qualifications to serve on the Board include her extensive managerial experience and her success in building revenues, improving organizational culture and sustaining organizational growth as well as her recognition as a leader in the restaurant and foodservice industry. | |

DIRECTOR SINCE: 2018 AGE: 64 INDEPENDENT: YES COMMITTEES: •Audit •Compensation |

6 DDR Corp.ï 2016 Proxy Statement

Transactions with the Otto Family In 2009, we entered into a stock purchase agreement with Mr. Alexander Otto. PursuantOtto pursuant to this agreement, Mr. Otto and certain members of his family, whom we collectively refer to aswhich the Otto Family purchased 40,000,000 common shares which we refer to asof the Purchased Shares.Company. In connection with the sale of the Purchased Shares,this transaction, we also entered into an investor rights agreement with Mr. Otto under which he has a right to nominate individualsan individual for election to our Board depending on the Otto Family’s level of ownership in the Company. During such time asSpecifically, if the Otto Family beneficially owns 17.5% or more of our outstanding common shares, our Board will nominate two persons recommended by the Otto Family who are suitable to us to become members of our Board at each annual election of directors, and during such time as the Otto Family beneficially owns less than 17.5% but more than 7.5% of our outstanding common shares as of the record date for the applicable meeting of shareholders, our Board will nominate one person recommended by the Otto Family who is suitable to us to become a member of our Board at each annual electionBoard. As of directors.March 15, 2024, the record date for the Annual Meeting, to our knowledge the Otto Family beneficially owned approximately 13.4% of our outstanding common shares. In accordance with the investor rights agreement, Dr. Finnethe Otto Family has been proposed, byand our Board has nominated, Mr. Otto and subsequently nominated and elected to our Board annually since 2009. Beginning in 2015, Mr. Otto has designated himself as the second person to be nominated by our Board pursuant to the investor rights agreement. Although pursuant to the investor rights agreement Mr. Otto was entitled to recommend one individual for nomination to the Board as of the record date, the Nominating and Corporate Governance Committee recommended, and the Board approved, nominating both Mr. Otto and Dr. Finne as Directorselection at the 2016 Annual Meeting. In April 2014, we sold our 50% ownership interest in a joint venture which, directly or indirectly, owned certain assets in Brazil to Mr. Otto and his affiliates. Because Mr. Otto and Dr. Finne are employees or affiliates of either certain of the entities that purchased the Company’s joint venture interest or affiliates of such purchasing entities, Mr. Otto and Dr. Finne are not currently deemed independent under the Securities and Exchange Commission (SEC) and New York Stock Exchange (NYSE) rules.

Independent Directors Our Board has affirmatively determined that all of the Directors who served during 2015, as well as all nominees for election at our Annual Meeting2023 (except for Mr. Otto, Dr. FinneLukes) were, and all Directors nominated by the Board for election in 2024 (except for Mr. Oakes),Lukes) are, independent within the meaning of the rules of the NYSENew York Stock Exchange (“NYSE”) and, as applicable, the rules of the SEC,Securities and Exchange Commission (“SEC”), including with respect to the applicable Director’s service on the Executive Compensation Committee andand/or the Audit Committee. Our Corporate Governance Guidelines provide that our Board will be comprised of a majority of independent directorsDirectors and that only those directorsDirectors or Director nominees who meet the listing standards of the NYSE will be considered independent. Our Board reviews annually the relationships that each Director or Director nominee has with us (either directly or indirectly), and only those Directors or Director nominees whom our Board affirmatively determines have no material relationship with us will be considered independent. Director Qualifications and Review of Director Nominees The Nominating and Corporate GovernanceESG Committee periodically reviews annually with our Board the composition of our Board as a whole and recommends, if necessary, actionactions to be taken so that our Board reflects the appropriate balance of knowledge, experience, skills, expertise and diversity required for our Board as a whole and contains at least the minimum number of independent directorsDirectors required by applicable laws and regulations and our Corporate Governance Guidelines. The Nominating and Corporate GovernanceESG Committee is responsible for ensuring that the composition of our Board appropriately reflects the needs of our business and, in furtherance of this goal, proposing the addition of Directors and requesting the resignation of Directors for purposes of ensuring the requisite skill sets and commitment of the Directors to actively participate in Board and committee meetings. Directors should possess such attributes and experience as are necessary to provide a broad range of personal | | | | SITE Centers Corp.ï 2024 Proxy Statement | | 11 |

characteristics including diversity, management skills, and real estate and general business experience. Directors should commit the requisite time for preparation and attendance at regularly scheduled Board and committee meetings, as well as participate in other matters necessary to ensure we are well-positioned to engage in best corporate governance practices. DDR Corp.ï 2016 Proxy Statement 7

In evaluating a directorDirector candidate, the Nominating and Corporate GovernanceESG Committee considers factors that are in the best interests of the Company and its shareholders, including the knowledge, experience, integrity and judgment of each candidate; the potential contribution of each candidate to the diversity of backgrounds, experience and competencies that our Board desires to have represented; each candidate’s ability to devote sufficient time and effort to his or her duties as a director;Director; independence and willingness to consider all strategic proposals; any other criteria established by our Board and any core competencies or real estate expertise necessary to staff Board committees. In addition, the Nominating and Corporate GovernanceESG Committee will consider potential members’ qualifications to be independent under the NYSE listing standards in accordance with our Corporate Governance Guidelines, and will assess whether a candidate possesses the integrity, judgment, knowledge, experience, skills, and expertise that are likely to enhance our Board’s ability to oversee our affairs and business, including, when applicable, to enhance the ability of committees of our Board to fulfill their duties. The Nominating and Corporate GovernanceESG Committee will consider suggestions forwarded by shareholders to our Secretary concerning qualified candidates for election as Directors. To recommend a prospective nomineecandidate for the Nominating and Corporate GovernanceESG Committee’s consideration and potential recommendation to the Board for nomination for Director, a shareholder may submit the candidate’s name and qualifications to our Corporate Secretary David E. Weiss, at the following address: 3300 Enterprise Parkway, Beachwood, Ohio 44122. The Nominating and Corporate GovernanceESG Committee has not established specific minimum qualifications that a candidate must have to be recommended to our Board. However, in determining qualifications for new Directors, the Nominating and Corporate GovernanceESG Committee considers those guidelines described above. The Nominating and Corporate GovernanceESG Committee will consider a pool of potential Board candidates established from recommendations from shareholders and third parties, including management and current Directors, as well as pursuant to the investor rights agreement described above under the caption “Transactions with the Otto Family.” The Nominating and Corporate GovernanceESG Committee may, in its discretion, retain a search consultant to supplement the pool of potential Board candidates considered for nomination. In connection Our Code of Regulations sets forth the requirements with respect to the nomination of Mr. August,candidates for Director by shareholders. Proxy Access Our Code of Regulations provides proxy access pursuant to which a shareholder or group of up to 20 shareholders satisfying specified eligibility requirements may include Director nominees in our proxy materials for annual meetings. To be eligible to use proxy access, such shareholders must, among other requirements: | • | | have owned common shares equal to at least 3% of the aggregate of our issued and outstanding common shares continuously for at least three years; |

| • | | represent that such shares were acquired in the ordinary course of business and not with the intent to change or influence control and that such shareholders do not presently have such intent; and |

| • | | provide a notice requesting the inclusion of Director nominees in our proxy materials and provide other required information to us not more than 150, or less than 120, days prior to the anniversary of the date that we issued our proxy statement for the prior year’s annual meeting of shareholders (unless the date for the upcoming annual meeting of shareholders is more than 30 days before or more than 60 days after the anniversary date of the prior year’s annual meeting in which case the notice must be received not later than the close of business on the later of the 150th calendar day prior to such annual meeting and the tenth calendar day following the day on which public announcement of the date of the annual meeting is first made). |

The maximum number of Director nominees that may be submitted pursuant to these provisions may not exceed 20% of the Nominating and Corporate Governance Committee utilized the servicesnumber of Ferguson Partners L.P., which recommended Mr. August for nomination.Directors then in office but in no event shall such maximum number be less than two. Majority Vote Standard Consistent with best corporate governance practices, the Company’s Articles of Incorporation provide for a majority vote standard in uncontested elections and a plurality vote standard in contested elections.elections of Directors. An election of Directors is contested when the number of nominees for election as a Director exceeds the number of Directors to be elected. Under a majority vote standard, each vote is specifically counted “for”“For” or “against”“Against” the Director’sDirector nominee’s election and an affirmative majority of the total number of votes cast “for”“For” or “against”“Against” a Director nominee will be required for election. Shareholders are entitled to abstain with respect to the election of a Director.Director nominee. With respect to the election of Directors, broker non-votes and abstentions will not be considered votes cast at the Annual Meeting and will be excluded in determining the number of votes cast at the Annual Meeting. Cumulative Voting

If written notice is given by any shareholder to our President, any Vice President or the Secretary at least 48 hours before the Annual Meeting that the shareholder desires that cumulative voting be used for the election of Directors, and if an announcement of the giving of that notice is made when the Annual Meeting is convened by the Chairman of the Board, the President or the Secretary, or by or on behalf of the shareholder giving that notice, then each shareholder will have the right to cumulate the voting power that the shareholder possesses in the election of Directors. This means that each shareholder will be able to give one candidate a number of votes equal to the number of Directors to be elected multiplied by the number of common shares owned by such shareholder, or to distribute the shareholder’s votes on the same principle among two or more candidates, as the shareholder may elect. If voting for the election of Directors is cumulative, the persons named in the accompanying Proxy Card will vote the common shares represented by proxies given to them in such manner so as to elect as many of the nominees as possible.

| | | | 12 | | SITE Centers Corp.ï 2024 Proxy Statement |

8 DDR Corp.ï 2016 Proxy Statement

3. Board Governance Board Leadership Mr. Ahern serves as Chairman of the Board. The position of Chairman of the Board is a non-executive officer position and is expected to be held by a non-employee,non-management, independent Director. The Chairman of the Board has the following responsibilities, among others as may be determined by our Board: | • | | Ensure that our Board fulfills its oversight and governance responsibilities; |

• | | Consult and advise on any operational matters as requested by our Chief Executive Officer;CEO; |

• Coordinate the Board’s self-assessment and evaluation process; | | •Serve as liaison between the Company’s management and the non-management Directors;

|

• | | Coordinate the Board’s annual review of, and input toon, the Company’s strategic plan; |

• | | Assist the Nominating and Corporate GovernanceESG Committee on corporate governance matters, such as the nomination of Board members, committee membership and rotation, and management succession planning; |

• | | Preside over meetings of our shareholders;shareholders if the President is unavailable; and |

• | | Provide leadership to our Board and set the agenda for, and preside over, Board meetings and executive sessions of the independent and non-management Directors. |

We believe that an independent Chairman of the Board, separate from our Chief Executive Officer,CEO, recognizes the time, effort and commitment that our Chief Executive OfficerCEO is required to devote to his position and to fulfill his responsibilities and the independent oversight required by our Chairman of the Board. This structure also enables our Board as a whole to fulfill its responsibility to oversee the risks presented by the Company’s long-term strategy, business plan and model. Meetings of Our Board During the fiscal year ended December 31, 2015,2023, our Board held five meetings and undertook onenine written action. In 2015, allactions. Each of our Directors attended 100%at least 75% of the aggregate of (i) the number of meetings of ourthe Board withthat were held during the exceptionperiod that such person served on the Board and (ii) the number of a Director who was absent for one meeting due to international travel.meetings of committees of the Board held during the period that such person served on such committee. As stated in our Corporate Governance Guidelines, all Directors are expected to attend the Annual Meeting. All of our then current Directors nominated for election virtually attended the Annual Meeting of Shareholders in May 2015.2023. Our Board conducts and reviews its operations through a self-assessment process on an annual basis. Meetings of Non-Management and Independent Directors The non-management Directors meet in executive session in conjunction with each regularly scheduled Board meeting. These meetings are chaired by the Chairman of the Board. In addition, as required by our Corporate Governance Guidelines, the independent Directors meet at least once per year.year to the extent our Board includes one or more non-management Directors who are not independent.

| | | | SITE Centers Corp.ï 2024 Proxy Statement | | 13 |

Committees of Our Board During 2015 and during 2016 prior to our Annual Meeting,2023, our Board established each ofhad the committees described below. The information regarding our committees set forth below reflects the participation of (i) Mr. Craig Macnab and Ms. Rebecca L. Maccardini, who served on our Board during 2015 prior to the 2015 Annual Meeting but were not nominated for election to our Board at our 2015 Annual Meeting, (ii) Mr. Oakes, who was elected to our Board in February 2015, and (iii) Mr. James C. Boland, who currently serves as a Director, but was not nominated for election to our Board at the 2016 Annual Meeting. Our Board has approved the written charters of the Audit Committee, the Executive Compensation Committee and the Nominating and DDR Corp.ï 2016 Proxy Statement 9

Corporate Governance ESG Committee, which, along with our Corporate Governance Guidelines, are posted on our website atwww.ddr.comwww.sitecenters.com, under “Governance” in the “Investors”“Investor Relations” section. Each of the Audit Committee, Executive Compensation Committee and Nominating and Corporate GovernanceESG Committee conducts a self-evaluation and review of its charter annually and reports the results of these evaluations and reviews to our Board. The information contained on or accessible through our website is not incorporated by reference into this Proxy Statement, and you should not consider such information to be part of this Proxy Statement.

| | | | | AUDIT COMMITTEE

| | | | Members:

• Mr. Roulston (Chair)

• Mr. Boland

• Mr. Gidel (commencing May 12, 2015)

• Ms. Maccardini (prior to May 12, 2015)Audit Committee

| | | | | | Responsibilities: The Audit Committee assists our Board in overseeing: the integrity of our financial statements; our compliance with legal and regulatory requirements; our independent registered public accounting firm’s qualifications and independence; the performance of our internal audit function and our independent registered public accounting firm; ourthe assessment and management of enterprise risk management policiesrisk; and procedures;management’s initiatives and practices with respect to information technology and cybersecurity. The Audit Committee also prepares the Audit Committee Report included in our annual proxy statement. Independence: All of the members of the Audit Committee are independent as independence is defined in the rules and regulations of the SEC and the NYSE listing standards, in accordanceincluding with our Corporate Governance Guidelines.respect to service on the Audit Committee. Our Board has determined that each current member of the Audit Committee and each member that served on the Audit Committee in 2023 is an “audit committee financial expert” within the meaning of Item 407 of Regulation S-K under the federal securities laws.laws other than Ms. Abraham, who otherwise meets audit committee financial literacy requirements. Meetings: The Audit Committee held tensix meetings in 2015. All members attended 100% of the meetings.2023. | | Members: •Ms. DeFlorio (Chair) •Mr. Ahern •Ms. Abraham •Ms. Sweeney |

| | | | | EXECUTIVE COMPENSATION COMMITTEE

| | | | Members:

• Mr. Gidel (Chair)

• Mr. Boland

• Mr. MacFarlane

• Mr. SholemCompensation Committee

| | | | | | Responsibilities: Among other responsibilities, the Executive The Compensation CommitteeCommittee: reviews and approves compensation for our executive officers; reviews and recommends to our Board compensation for Directors; oversees the Company’s equity compensation and executive benefit plans, including those under which such executive officersplans; and Directors receive benefits; reviews and discusses with management the Compensation Discussion and Analysis and produces the Compensation Committee Report in our annual proxy statement. The Executive Compensation Committee engages a compensation consultant to assist in the design of the executive compensation program and the review of its effectiveness, as further described below under the caption “Compensation Discussion and Analysis.” The Chief Executive Officer providesCEO makes recommendations to the Executive Compensation Committee recommendations regarding compensation for executive officers other than himself for approval by the committee,Compensation Committee, and the Executive Compensation Committee delegates to senior management the authority to administer certain aspects of the compensation program for non-executive officers. In addition, the Executive Compensation Committee may form subcommittees of at least two members for any purpose it deems appropriate and may delegate officers, including certain equity award grant authority subject to the subcommittees anyrequirements of its powerapplicable law and authority that the Executive Compensation Committee deems appropriate.terms of our equity plan. Independence: All of the members of the Executive Compensation Committee are independent as independence is defined in the rules and regulations of the SEC and the NYSE listing standards, including with respect to service on the Executive Compensation Committee, in accordance with our Corporate Governance Guidelines.Committee. Meetings: The Executive Compensation Committee held twofive meetings and took written action on four occasions in 2015. All members attended 100% of the meetings. |

2023. 10 DDR Corp.ï 2016 Proxy Statement

| | | | | NOMINATING AND CORPORATE GOVERNANCE COMMITTEEMembers:

•Mr. Ahern (Chair) •Ms. DeFlorio •Ms. Sweeney |

| | | | 14 | | SITE Centers Corp.ï 2024 Proxy Statement |

| | | Members:

• Mr. Ahern (Chair) (commencing May 12, 2015)

• Mr. MacFarlane

• Mr. Macnab (prior to May 12, 2015)Nominating and ESG Committee

| | | | | | Responsibilities: The Nominating and Corporate Governance CommitteeESG Committee: identifies individuals qualified to become members of our Board and recommends to our Board the persons to be nominated as Directors at each annual meeting of shareholders; recommends to our Board qualified individuals to fill vacancies on our Board; reviews and recommends to our Board qualifications for committee membership and committee structure and operations; recommends Directors to serve on each committee; develops and recommends to our Board corporate governance policies and procedures in compliance with the Sarbanes-Oxley Act of 2002, the Dodd-Frank Wall Street Reform and Consumer Protection Act and other rules and regulations relating to our corporate governance; oversees compliance with,receives periodic reports from management on our ESG initiatives and related topics; reviews and makes recommendations regarding any waivers under our Code of Business Conduct and Ethics with respect to officers and Directors; and leads our Board in its annual review of the performance of our Board. Independence: All of the members of the Nominating and Corporate GovernanceESG Committee are independent as independence is defined in the NYSE listing standards and in accordance with our Corporate Governance Guidelines.standards. Meetings: The Nominating and Corporate GovernanceESG Committee held fivethree meetings in 2015. All members attended 100% of the meetings.2023. | | Members: •Mr. MacFarlane (Chair) •Ms. Abraham •Mr. Sholem |

| | | | | DIVIDEND DECLARATION COMMITTEE

| | | | Members:

• Mr. Oakes (Chair) (commencing February 10, 2015)

• Mr. Ahern (commencing May 12, 2015)

• Dr. Finne

• Mr. Macnab (prior to May 12, 2015)

Dividend Declaration Committee | | | | | | Responsibilities: As may be authorized by the Board, the Dividend Declaration Committee determines if and when we should declare dividends on our capital shares and the amount thereof, consistent with the dividend policy adopted by our Board. Meetings: The Dividend Declaration Committee held one meeting in 2015 and all members attended this meeting.did not meet during 2023. The Dividend Declaration Committee also took written action on four occasions in 2015.2023. | | Members: •Mr. Lukes (Chair) •Mr. Ahern |

| | | | | PRICING COMMITTEE

| | | | Members:

• Mr. Oakes (Chair) (commencing February 10, 2015)

• Mr. Ahern

• Mr. Roulston

Pricing Committee | | | | | | Responsibilities: The Pricing Committee (or duly appointed subcommittee thereof) is authorized to approve the timing, amount, price and terms of offerings of our debt and equity securities. Meetings: The Pricing Committee (or duly appointed subcommittee thereof) took written action on two occasionsdid not meet in 2015.2023. | | Members: •Mr. Lukes (Chair) •Mr. Ahern •Ms. DeFlorio |

DDR Corp.ï 2016 Proxy Statement 11

Risk Oversight WithManagement is responsible for the day-to-day management of risks, while the Board, as a Board comprised of management, independent Directorswhole and non-independent Directors, members ofthrough our Board bring a variety of perspectives to address risks faced by our Company. Our Board’s role in enterprise risk management (ERM) includes receiving regular reports from members of senior management on areas of material risk to the Company, including operational, financial, strategic and compliance risks. The Company has an ERM Committee, comprised of senior management and chaired by the Chief Executive Officer, which meets regularly to address risk and risk mitigation strategies. The Chair of the Audit Committee, is invited to attendresponsible for overseeing the risk assessment and participate in ERM Committee meetings.risk management functions of the Company. The Audit Committee assists our Board in its oversight responsibilities by, among other matters, reviewing reports prepared by the ERM Committee,has delegated responsibility for reviewing our policies and procedures with respect to risk assessment and risk management risk monitoring and risk mitigation and working with the other committees ofto our Board to identify additional risks related to the committees’ respective areas of expertise. The Chair of the relevant committee consults with the Audit Committee regarding the committee’s findings regarding the identified risks and the committee’s proposals to address such risks.through its charter. The Board has determined that this oversight responsibility can be most efficiently performed by our Audit Committee then reports, on at least an annual basis, to our full Board on the Company’s ERM program. This enables our Board andas part of its committees to coordinate their riskoverall responsibility for providing independent, objective oversight role, particularly with respect to interrelated risks. Moreour accounting and financial reporting functions, internal and external audit functions, systems of internal control over financial reporting, security of information concerningtechnology systems and data, and legal, ethical and regulatory compliance. Our Audit Committee regularly reports to the Company’s ERM program can be found on our website atwww.ddr.com, under “Enterprise Risk Management” in the “About Us” section under “News.”Board with respect to its oversight of these areas.

Compensation of Directors Director Compensation Program During 2015, the 2023, our non-employee Directors were compensated in the form of an annual cash retainer and an annual stockequity retainer. The equity retainer is payable in a combination of a fixed-dollar grant and a fixed-share grant as shown below, in ordersummarized below. | | | | SITE Centers Corp.ï 2024 Proxy Statement | | 15 |

Our Director compensation program, including the fixed-share portion of the annual equity retainer, is intended to better align the interests of our Directors and our shareholders. | | | | | ComponentCOMPONENT | | Annual AmountANNUAL AMOUNT | | PayablePAYABLE | Annual Fixed-Dollar Stock Retainer | | Grant of 8,000 common shares

| | Upon election at the

annual meeting of shareholders | Annual Cash RetainerEqual in value to $60,000

| | Quarterly in common shares | $50,000Annual Fixed-Share Stock Retainer

| | 3,800 common shares | | Quarterly in common shares | Annual Cash Retainer | | $60,000 | | Quarterly in cash or common shares, at the director’sDirector’s election |

Non-employee Directors are also paid fees for service on certain committees as set forth below and for service as the Chairman of the Board. The Director who serves as the Chairman of the Board receives an annual fee of $100,000 in addition to the fees paid to all non-employee Directors. Fees are paid to committee members, the respective committee chairs and the Chairman of the Board in quarterly installments in the form of cash or common shares, at athe Director’s election. Each Director is also reimbursed for expenses incurred in attending meetings because we view meeting attendance as integrally and directly related to the performance of the Directors’ duties. | | | | | | | | | | | | Annual Fee | | | Committee | | Chair ($) | | | Member ($) | | | Audit Committee | | | 40,000 | | | | 25,000 | | | Executive Compensation Committee | | | 40,000 | | | | 25,000 | | | Nominating and Corporate Governance Committee | | | 30,000 | | | | 20,000 | | | Dividend Declaration Committee | | | — | | | | — | | | Pricing Committee | | | — | | | | — | |

| | | | | | | | | | | | | | ADDITIONAL ANNUAL FEE | | COMMITTEE | | CHAIR ($) | | OTHER MEMBER ($) | Audit Committee | | | | 40,000 | | | | | 25,000 | | Compensation Committee | | | | 40,000 | | | | | 25,000 | | Nominating and ESG Committee | | | | 30,000 | | | | | 20,000 | | Dividend Declaration Committee | | | | — | | | | | — | | Pricing Committee | | | | — | | | | | — | |

12 DDR Corp.ï 2016 Proxy Statement

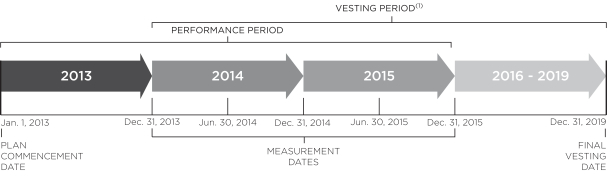

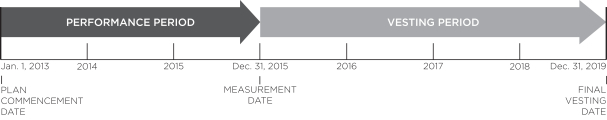

20152023 Director Compensation